- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

I wanted to bring some info over to the Square Community from various parts of the web to help only as a guide for small business starting out or established business' to further expand their profile. I am in no way an expert, nor a consultant for legal advice and YMMV as with anything. As with all credit, be responsible.

Establish the Business

(mostly if you are here, you have probably already done this, but I will list some steps for others who may not be at that point.

- Name Your Company

- Incorporate Your Company

- Obtain an EIN

- Establish A Location

- Establish a Business phone number.

- Establish A business checking account

- Establish A D-U-N-S Number (Dunn & Bradstreet aka D&B)

If you don't currently have a DUNS number, you can obtain a FREE one. DO NOT pay for their services. It is not necessary to pay for a DUNS number but a sales rep may call you and try to talk you into paying for one, and or "speeding" up the process.

Establish Business Credit

Establish your business Net 30 Accounts. Once you have all the above figured out, you can began to apply for some net 30 accounts. Do not go on an app spree by applying to many places at once, this could potentially block your account and have a negative effect. 3-4 Net 30 Accounts seem to be a sufficient start to building your business credit. Below is a list of current companies that offer Net 30 Accounts. Once Approved, make a small purchase each month for a couple of months. There is no need to spend more than you can. to get the best D&B PayDex score possible, try to pay off at least 15 days before the statement due date, otherwise just be sure to be by the due date.

- Fedex/Kinkos

- Quill

- ULine

- NEbs

- Reliable

- Office Depot

- Gemplers

- Grainger

- NewEgg Business (net 30)

WHAT IS A PAYDEX SCORE - A Paydex score is what D&B uses to tell potential creditors about your payment history and worthiness. It scales from a range from 0 to 100, with 100 being the best possible score. You are going to want to keep your Paydex score at or above 80. Paydex score are broken down as follows:

100 - Pays before invoice is generated

90 - Pays during discount period

80 - Pays when invoice is due

70 - Pays 15 days beyond terms

60 - Pays 22 days beyond terms

50 - Pays 30 days beyond terms

40 - Pays 60 days beyond terms

20 - Pays 90 days beyond terms

UN - Unavailable

WAIT FOR PAYDEX SCORE - In order to receive a Paydex score, you will need to have five tradelines reporting to D&B. Once you have five reporting you will be assigned your Paydex score. Now that you have this Paydex score you can move on to establishing revolving accounts, you can move on to Building Your Business Credit.

Building Your Business Credit

- Establish more Tradelines- Now that you have a paydex score, you are going to want to see companies for revolving credit lines. Again, you do not want to go on an app spree. Apply for a couple new accounts and then wait a few weeks before applying for a few more. Applying for too many at once can negatively effect your business score.

- Below is a list of companies that offer revolving credit on terms.

- **Please remember that if they ask you for a personal guarantee to tell them you DO NOT want to give it. Most times the company will just process the application without it.**

- Staples

- Walmart Community Card by Capital One (not accepting new applications at this time) 7/7/22

- Dell-(No PG)

Amazon Business Net 55(no longer offered as of 1/2/23)- Lowes Corporate Net 30 (NO PG)

- Home Depots Corporate Account (No PG)

- Sams Business Store Card

- Floor & Decor (No PG)\

- Ford Credit- It is possible to obtain a vehicle loan based on EIN only

Below are a list of gas companies that offer credit cards for companies without a personal guarantee as well, and come in handy when on the road for business.

- Conoco 76

- Shell

- Exxon/Mobile

- Chevron

- Sunoco

From all of my research, there are only two companies that offer a Business Credit Card without a PG (personal guarantee) since the bank bailout of 2008. Yes you can still get a business card like AMEX, Chase, Capital One Spark etc but all of those will run your personal credit, and the point of this is to build your Business Credit.

- Sams Club Business Mastercard- You must be a member and you must print out and out the application in store. You CAN NOT apply for this online. (decline PG when filling out the application in store and make sure the associate knows you are not PG'ing this)

- Citizens Bank Business Card- You must reside in a state where they offer their services. The company will only do a soft pull on your personal credit, and pull your EQ business report

- GM Business Card- This is issued by Marcus Goldman Sachs.

Business Charge Cards

Here is a list of soft Pull credit cards some of these are revolving credit, but with higher interest, so you should treat it like a charge card and Pay in Full every month. All of these will be a soft pull on personal credit , but a hard pull on Business Credit. Thanks to KnowledgeSeekr for putting this list together. Most of these will require you to connect our business bank via Plaid, or upload 3-6 months of bank statements when submitting the application.

Checking out your Business Credit Scores

D&B Paydex Score- Iupdate.dnb.com Once you have your tradelines set up you can view your paydex score on the site listed. THis site can be very slow, and is usually down, but seems to work best on Sundays

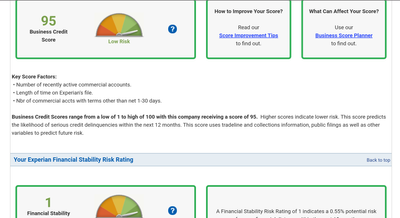

Nav- Nav.com will show your Experian Business Credit Score. They offer some great resources as well to further your business credit adventure.

note* They usually don't show Equifax Business score, and most companies don't look at the Equifax score.

Experian Business If you are serious about building your business credit, and once you have some tradelines and revolving credit lines open, it may be worth purchasing their annual report. It is slightly less than $200 annually so i would only suggest using it if/when you are serious about your score.

Ecredable- (Business account) Link utility accounts (water, electric, cell, landline, internet, some net accounts) to ecredable, they can then report upto 24 months of payment history to your business credit reports. Upfront fee of $49.95, followed by $9.99/a month. This can be useful to help build accounts that don't/won't normally report to your business credit report.

I will update this thread with information as needed, and if you have any questions feel free to ask, and I will try my best to answer them. Happy Business Credit Building!

absolutely, @erikjones and same to you. If you ever come across any new info that may be useful, feel free to share it and I'll update this thread

Side note. I'm Not sure which card you have with Capital One, but you can always try to product change it (no harm, no credit pull) if their are offers available they will tell you and then give you a chance to review it. For example if you have the Business Spark Classic (1.5% cash back) you could be eligible for the Spark Cash Plus (2% cash back)

If you log into your capital one account, and then click on the account in question up in the address bar after the = sign add /productupgrade and hit enter, it will either offer you a different card, or say sorry not offers available. It works with their personal cards, so i assume its the same with business cards.

THanks again, and good talking

Cheers

@Minion I absolutely will!

That's a great note on the Capital One card too! Originally I was presented with both options and decided to select the Business Spark Classic. If I recall correctly, I didn't feel confident we were going to use enough of the credit available on that account to negate the annual fee of the Spark Cash Plus. And being that I was already a Capital One customer personally, the new account wasn't eligible for any sign up bonuses.

Regardless of all that... definitely a super useful reminder of this option! Especially if/when our spending on that account increases.

Appreciate the reminder!

@Minion I had another thought about this! I may have not been able to avoid a personal credit pull on the Amex after all. After further review, this is what I believe happened...

The first card, with Capital One, did reflect on my personal report as a credit check. Now this is where the review part comes in. There was not as much time as I originally thought between the opening of the two accounts. While the Amex is solely a business card, a personal credit check was still required. This second credit check didn't appear, or affect my credit, simply because the two reports were within a few weeks of each other. It does depend on the credit scoring model, but according to Equifax, this window is normally 14 - 45 days.

I was aware of this grace period that allows for multiple checks to appear as one - giving the consumer the option to shop around a bit for credit or loan options, without decimating their credit - but I actually did not believe the two were within that window. So perhaps thats where my luck came in! @Minion 😂

Hope this clears that up! So for anyone looking to obtain business credit that will require a personal credit check, just remember, you have up to a 45-day period to shop around, fill out applications, have a credit check or two, and then make your decision from that point.

Hope this helps!

@erikjones wrote:@Minion I had another thought about this! I may have not been able to avoid a personal credit pull on the Amex after all. After further review, this is what I believe happened...

The first card, with Capital One, did reflect on my personal report as a credit check. Now this is where the review part comes in. There was not as much time as I originally thought between the opening of the two accounts. While the Amex is solely a business card, a personal credit check was still required. This second credit check didn't appear, or affect my credit, simply because the two reports were within a few weeks of each other. It does depend on the credit scoring model, but according to Equifax, this window is normally 14 - 45 days.

I was aware of this grace period that allows for multiple checks to appear as one - giving the consumer the option to shop around a bit for credit or loan options, without decimating their credit - but I actually did not believe the two were within that window. So perhaps thats where my luck came in! @Minion 😂

Hope this clears that up! So for anyone looking to obtain business credit that will require a personal credit check, just remember, you have up to a 45-day period to shop around, fill out applications, have a credit check or two, and then make your decision from that point.

Hope this helps!

I appreciate the info.

Yeah its unfortunate that most business credit cards require the Personal Guarantee no days, (other than the few I listed there).

I always suggest also trying to go for the Pre-qualify page from a business prior to the actual application. Some of them like Chase/Amex Pre qualify sites are generally pretty solid offers,otherss like Bank of America (unless you are a current product holder and can login to an account) are more of like a marketing, so always take even pre qualify with a grain of salt, but still a soft pull is better than a hard pull.

Ill add some more info later also on which business cards report to what bureau, and what reports they use to pull the sores from.

Wanted to give a 2022 update.

I used Ecredible for about 4 months. The initial payment, and 9.99/month, to see if it would show an Equifax business score on Nav.com and it still hasn't so I have cancelled it. I'm not sure if it just isn't updating on Nav, or if Equifax is just that bad (It is actually pretty horrible in reporting business lines, and if you dispute information I have read that they can/have been known to delete your file by "accident", Be warned)

I did apply for the Walmart Net 30 card to round out 2021, and was approved for $2500 with no PG. If anyone decides to try it, I found it didn't work on my laptop using Chrome, and I had to do so using my phone on chrome only.

My list of tradelines-

Dell- $7500

Grainger-$5000

Newegg Business-$2500

Exxon Mobile-$1000

Amazon Business Net 30- $7000

Walmart Net 30-$2500

My Business Score just updated from 77 to 95 on Experian Business and both A ratings for D&B and Experian on Nav. Equifax still isn't showing yet. I will find out next month if using ecredible worked as I'll be going for the Citizens Business Card with no PG and they still/only use Equfiax Biz reports.

Thanks for the info. I'm struggling to build business credit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

This is extremely helpful, thank you!!

Just posting in an update in this thread. The Walmart Community Card by Capital One seems to be not accepting new applicants at this time. Anyone with one has been grandfathered in.

After 2 years of trying to get the Sams Club Business Mastercard , I was finally approved the other day. I'm unsure of Starting Limit, but being from Synchrony as finnicky as they can be with applications, any of their accounts can grow quickly.

Back story for anyone else who may have been trying for that. This was my experience with them over a 2 year period.

(note, I have an Amazon Net 55 account and Lowes 4 Pros account which are both synchrony)

Became a member and applied in store- Denied 7-10 day letter.

-6 months or so later tried again, denied 7-10 day letter

-6 months later...you guessed it...denied 7-10 day letter.

By the 3rd denial I was determined to speak with someone since the reasoning, which in most cases is as simple as couldn't verify business phone, EIN or similar. 45 minute phone call of being transferred around two a handful of reps, they were finally able to verify the business and I was approved for the Store Card at 8k limit. Not the one I wanted, but it is Extremely common for them to give the store card first.

-It is suggested to wait 3-6 months before applying again (In store with paper application), I waiting just shy of 3 months.

About a half an hour in the store due to system error, the representative spoke on the phone with me to verify my information, came back with approved for the MasterCard. FINALLY!. I'm not sure of the limit but that is irrelevant to me.

Last goal for this year is to capitalize on the Citizens Bank Business Card which is only a soft pull on personal credit. The biggest problem with doing this without a PG is they (Citizens Bank) will pull Equifax business credit scores, and they are terrible at reporting business items correctly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

This was amazing. You truly dropped some valuable GEMS that a lot of others are charging for...and for that we are appreciative. I've been working on building my business credit over the past year now. It's doing pretty well...slowly but surly going up. You added some net 30 and 55 accounts that I didn't know of. I'm going to check into opening a few accounts with those to get the ball rolling a little faster. Again, thank you for this information 🙂

Absolutely not a problem, just spreading some info from Other forums. I will say a few things. I have the Amazon Net 55, Lowes 4 Pros , and both Sams Business cards the Store, and recently their Business MasterCard (which has been my goal for some time). All no PG. Synchrony, themselves can be extremely generous with credit increases generally every 4 months or so. With that being said, they do have a Max Exposure of 100K, and that is any combination of consumer, business, and Net terms accounts. So just be mindful of what cards/accounts of Synchrony you want to grow. Best practice to keep the exposure below 80k, as they have been known to close accounts without notice as well.

Best of luck @Stacelyn24 , and if you ever have any questions ask away and I can try to give some input.

Great info!

some of it doesn’t apply where I’m at but definitely great information for starting out!

I've seen your tips here before @Minion and these are so great, thanks for these. I often find this thread again when someone else posts a comment or update. I just wanted to share (vent) on an issue I've had over the past year or so. I have found it impossible to get a D&B number, or even get any communication from them. I don't even know if I have a number. I've registered on their site, have a log-in, and every 2-3 months go back and do the same thing...click on obtain a D&B number, it locates my biz address (which is affiliated with previous businesses at the the same address), so it says to apply for a new number. I never get an email or phone notification that I have been issued a number. I'm convinced that unless I "upgrade" to some paid package of services they offer...they will never give me any attention.

Is this just me, or have other people had trouble dealing with D&B??

@HC_Charlie wrote:I've seen your tips here before @Minion and these are so great, thanks for these. I often find this thread again when someone else posts a comment or update. I just wanted to share (vent) on an issue I've had over the past year or so. I have found it impossible to get a D&B number, or even get any communication from them. I don't even know if I have a number. I've registered on their site, have a log-in, and every 2-3 months go back and do the same thing...click on obtain a D&B number, it locates my biz address (which is affiliated with previous businesses at the the same address), so it says to apply for a new number. I never get an email or phone notification that I have been issued a number. I'm convinced that unless I "upgrade" to some paid package of services they offer...they will never give me any attention.

Is this just me, or have other people had trouble dealing with D&B??

You are not alone @HC_Charlie . DUNS is far worse than Equfiax business, and i feel like Tylenol was created because of D&B. They are not governed by the FCRA, so they can do a lot of shady things and practically get away with it. Their paid services are nothing more than just a sales pitch for new business owners. Generally though, if you can get a Net 30 account, they will auto populate you a DUNS number. Their site was recently updated maybe a year or two ago, and it was very clunky and sluggish before , and now its just overwhelming with useless information and still extremely clunky. It really shouldn't be that hard to get your DUNS number though, maybe it has to do with the the address of your location and them picking up a previous one?

If you haven't already, you can go to nav.com and sign up for a free account. You can then enter in your business information and if you have a DUNS, Experian, Equifax, or SBSS it will find it for you. (Nav is still pulling my Equifax from my old business name (same EIN) however). I am using Nav's paid quarterly service temporarily just to get more things to report to Equifax business but the free version is generally all that is needed.

If you do have a DUNS showing you can then click on the DUNS section > Business Information and it will show you your number if one is populated for your business. Hopefully there is,

Thanks @Minion for the tip about nav.com. I'm checking it out now and it looks like a great resource and tool to help my business!

I was able to purchase a new Ford a few months back from the local dealership with EIN only. I have also added some links to a few other Charge type Cards. I have a few of these cards (Divvy, Capital on tap, Torpago). These cards are good for keeping business separate, but just remember, while most of them are charge card, some (Capital on Tap or Torpago) are revolving, the interest rate is pretty high, so it would be best to Pay in Full each month if you do use them.

- « Previous

-

- 1

- 2

- Next »