- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Payroll: How do I account for employee cash advances/tips already paid?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

Hi @leefields, and kudos for your first post. 😊 Just doubled checked with our Payroll Support Team on this, and they confirmed that Square Payroll allows you to declare taxes on amounts already paid to your employees through the Tips Paid column of the Run Payroll screen. The amounts you enter into this field will not be paid out to your employees but will be taxed. You can use this column to ensure that tips paid out to your employees are taxed accordingly.

The recommendation for these employees that have already received partial pay, is to pay them the remainder of their wages via manual check. Issuing a check for these employees will ensure that taxes have been calculated correctly for the entire pay period. You will then write the check for the remainder of the wages owed for this period.

To issue a manual check:

- Visit Employees in the Payroll section of your Square Dashboard.

- Select the employee that you would like to switch to manual check.

- On the right side of the screen, click on the Payment Method drop-down and select Manual Check.

- Click Save and repeat for all employees that you would like to pay with written checks.

Square Payroll calculates and withholds taxes, and tells you the exact amount to pay your employee(s) if you choose to write checks manually. You can then manually write a personal or business check to your employee for the amount due. Each pay period, you’ll receive an email notification from Square with a list of employees requiring payment via check and the net amount for each check.

Hope this helps!

Sean

he/him/his

Product Manager | Square, Inc.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

This doesn't seem to be a valid workaround. I am needing to do the same thing because an employee is needing to pay rent before the direct deposit hits. When I change that employee to receive a paper check it still does not allow me to edit or adjust what to pay them in tips. That is being automatically calculated in the system because all of my employees are in a tip pool.

I tried turning that automatic tip pool feature off so that I can enter in tip amounts manually but there is still nowhere to designate how much I paid each employee in tips.

I could see this still being a solution if the paper check is mailed to the business and not the employee, but there is still the question of how do I void the check issued by Square to the employee, because I have already paid them, and get my money back.

I see no information on any support site for voiding a check issued to an employee, probably because that is a sketchy way of handling the problem.

Square needs a better workaround. If you have already paid an employee in cash tips there needs to be somewhere for you to enter that in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

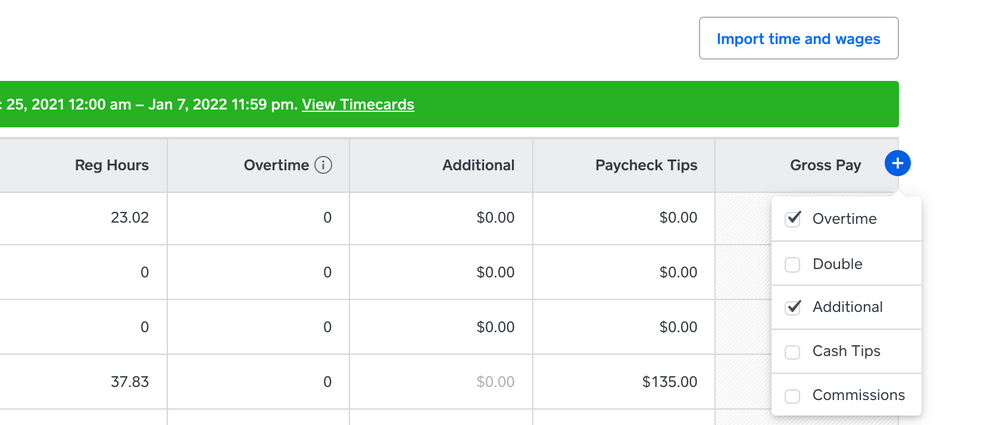

I have found that the "cash tips" and "payroll tips" are not automatically in the columns when making adjustments in the payroll run. in the same screen where you import your time cards, there is a blue plus button next to the "gross pay" column at the far right side of the table. There they have additional columns you can add to the table including the "cash tips" and "payroll tips". Once selecting the relevant column, it appears in the table and you can add your relevant amounts for each employee.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

Hi Sean!

Thanks for this answer, it makes sense to use the "cash tips" feature for cash advances. However, my issue now is that I don't see a way to deduct the relevant amount from the gross pay that's already been paid so that taxes are not over calculated now.

Example:

- We paid our employe $135 cash ahead of payroll; this was for hours worked based on their hourly rate of $10/hour.

- Now it's time for payroll, and with the recorded hours in Square, this employee has worked 37.83 hours in this pay period for a gross pay of $378.30.

- I add "Cash Tips" to the "Run Payroll" screen and enter the $135 as outlined in your post, and now gross pay has increased to $513.30. This of course makes sense if the pay the employee received was indeed cash tips as that would be in addition to their hours worked, but in this case it's not, it's supposed to be a credit on the wages for hours worked calculation.

I tried entering a negative number under "Additional", but the chart won't accept a negative number (using a - or parentheses).

Alternatively I could still just run payroll like this and write the manual check for $135 less, but Square is going to record and calculate taxes on the full (larger) gross amount of $513.30. Now we have the opposite problem of overpaying taxes instead of underpaying.

Another option would be deducting their number of hours worked to balance out the "cash tips". In this example, it would be 13.5 hours, which does bring the gross pay back down to the original $378.30 I don't love this solution as that removes those hours from the record. Theoretically, in the future, the employee could claim we misrecorded their hours and own them wages. I would add a memo to this payroll that explains the adjustment, but again, not ideal in my opinion because I want to minimize confusion for the employee.

Is there another way to make this adjustment in Square Payroll that I'm missing, or is the hours adjustment the only way to balance things back out?

Thanks in advance!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

Did you find a solution? I'm in the same boat.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

Hey @Sterlinglawns I am sorry you are having this issue as well.

Please sees @Sean response above. If that workaround doesn't work for you please reach out to our Square Payroll Support at 1-855-700-6000 squ.re/contactsqsupport, they might have more ideas or workarounds.

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report