- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

I need to generate a report that shows what Square deposited into my bank account. So the gross, minus the transaction fees, minus the Capitol loan payment. Currently there isn't any way to match up what was deposited into my bank account with what reports Square generates, so there is no way to reconcile my accounts. I've had 2 different accountants spend hours over this and they have both concluded I should leave Square for a real system, so unless a human person will speak to me and let us know how to find this so we can reconcile and use this information, that is exactly what I'll be forced to do. Please, SOMEONE help!

- Labels:

-

Accounting and Finance

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

Hello @ambernpm

You can definitely get reports for each transfer (aka Deposits) showing all fees removed. Capital payments are their own separate report, but it's relatively easy to get them all linked up.

For the Transfer Report:

Go to Balance -> Activity -> Transfers. If you have multiple locations, you can filter by location. Each transfer initiated by Square will be shown here depending on your date range. Clicking on each transfer will take you to a screen that will show your total transfer less any Square or delivery-related fees.

For the Capital Payment:

Go to Capital. All the Automatic Payment lines will be that day's payment.

Now here's the kicker: if you process credit cards beyond your end of day (which is set at 5 PST by default), the card sales will show up in the day, but the amount won't be transferred over to your account until the next day. These can be overridden in the Balance Settings, but by default this is how it's set up. This means there will be discrepancies with your deposits when reconciling your accounts. There isn't a way around this--this would be similar with all the "real system"s out there too.

Here's what I do when reconciling the deposits/transfers with my bank via Quickbooks:

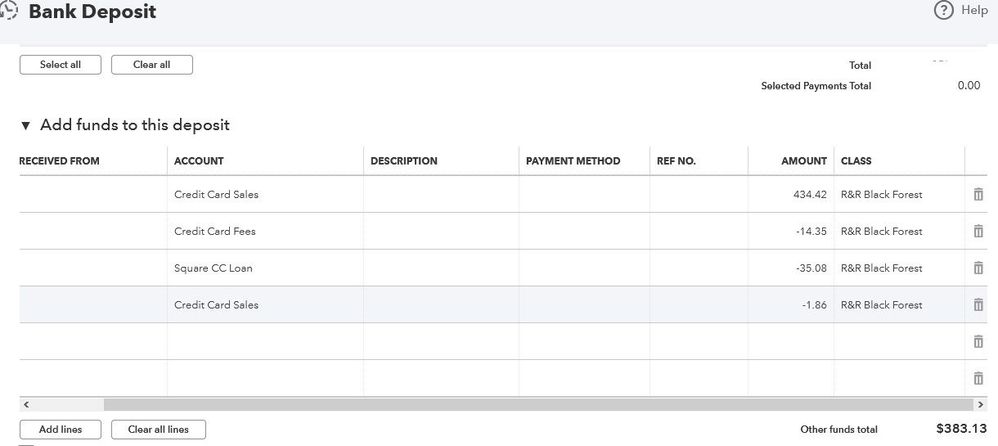

For this day, my bank reported $383.13 in a deposit. My CC sales for the day equaled $434.42. In QB, you can split your deposit by editing it. This is where I report my CC fees (-14.35) and the Capital Loan (-35.08). Since I had a small sale hit after the EOD cutoff, my credit card sales didn't match the bank, to the tune of 1.86. I made an additional CC sales entry to make things match. Some accountants would probably rather see that 1.86 in an A/R entry instead of a CC sales entry, but this works. The next day, my deposit was off 1.86, which made up for this discrepancy.

Your accountant may want to see this recorded a different way, though, so I'd consult with them before locking in procedures off of what I say.

As for contacting customer service, you can do so at the link in my signature below. Click "More..." then "I don't see my issue" to get to your customer code and contact information.

Golden Pine Coffee Roasters

Colorado Springs, CO, USA

Super Seller: I know stuff.

Beta Tester: I break stuff.

he/him/hey you/coffee guy/whatever.

Happy Selling!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

Hello @ambernpm

You can definitely get reports for each transfer (aka Deposits) showing all fees removed. Capital payments are their own separate report, but it's relatively easy to get them all linked up.

For the Transfer Report:

Go to Balance -> Activity -> Transfers. If you have multiple locations, you can filter by location. Each transfer initiated by Square will be shown here depending on your date range. Clicking on each transfer will take you to a screen that will show your total transfer less any Square or delivery-related fees.

For the Capital Payment:

Go to Capital. All the Automatic Payment lines will be that day's payment.

Now here's the kicker: if you process credit cards beyond your end of day (which is set at 5 PST by default), the card sales will show up in the day, but the amount won't be transferred over to your account until the next day. These can be overridden in the Balance Settings, but by default this is how it's set up. This means there will be discrepancies with your deposits when reconciling your accounts. There isn't a way around this--this would be similar with all the "real system"s out there too.

Here's what I do when reconciling the deposits/transfers with my bank via Quickbooks:

For this day, my bank reported $383.13 in a deposit. My CC sales for the day equaled $434.42. In QB, you can split your deposit by editing it. This is where I report my CC fees (-14.35) and the Capital Loan (-35.08). Since I had a small sale hit after the EOD cutoff, my credit card sales didn't match the bank, to the tune of 1.86. I made an additional CC sales entry to make things match. Some accountants would probably rather see that 1.86 in an A/R entry instead of a CC sales entry, but this works. The next day, my deposit was off 1.86, which made up for this discrepancy.

Your accountant may want to see this recorded a different way, though, so I'd consult with them before locking in procedures off of what I say.

As for contacting customer service, you can do so at the link in my signature below. Click "More..." then "I don't see my issue" to get to your customer code and contact information.

Golden Pine Coffee Roasters

Colorado Springs, CO, USA

Super Seller: I know stuff.

Beta Tester: I break stuff.

he/him/hey you/coffee guy/whatever.

Happy Selling!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

Square does not give me that option. Do you use Square's bank? It should not matter

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

Hi @avalanchepeach,

I'd be happy to shed some light here! You can find a detailed report showing the funds we sent to your bank account here. The transfer report is the same for all banks, and includes card sales. For all other reports, visit the Reports section in your dashboard.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

Did you get an answer to your question? I am looking for the same thing. The response I see you received gives direction but it is not valid. I don't have those options.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

Hello there, @CreeksideRV7446 -

Yes, you can see reports for the transfers Square makes to your bank account. Since the previous post, some things in the Dashboard have been updated.

To get to this report, go to: Balance > Click the balance > View All Transfers

This will take you to the main Balance page. You can pick the date range for the transfers you're looking for and it will list everything. Also, there is an option to export the information, if needed.

Please let me know if you have any other questions.

Community Moderator, Square

Sign in and click Mark as Best Answer if my reply answers your question.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

Unfortunately, the export does not correlate with Square deposits. In other words, to match up my deposits with the activity export, I have to figure out which were deposited when and add them up manually. Like all things Square, they make it very convoluted, requiring a lot of manual manipulation. Is it so hard to just create a report that matches their deposits?

Or allow me to customize the activity screen so I can see them right on the screen without having to click on EVERY SINGLE ONE of the deposits?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report