- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Hello Seller Community!

Am I able to backdate or edit a transaction after the sale is complete? What if the sale occured earlier and I recived payment at a later date?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

Right now we have no plans to add the ability to backdate or manipulate transaction information after a sale is complete.

For context, the ability to manipulate transactions can cause issues for reporting, 1099-K's, and chargebacks. Also it would make it easier for fraudsters and scammers to commit crimes using Square Point of Sale.

Hopefully this has provided some transparency on this request, and why it's not available.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

@nika what about the ability to back date a *new* transaction? I made a number of cash sales directly (outside of Square/app) to friends, co-workers, etc., over the holidays and just plain forgot to enter the transactions in Square. Is this possible yet? Thanks much.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

Hi there, @thesewingstage 👋 Thanks for adding your voice here.

Adding a 'new' past date transaction within Square is still considered a feature request. In the event that there is news to share on this feature coming to fruition, we will be sure to update everyone here on this thread.

Thanks!

Community Moderator, Square

Sign in and click Mark as Best Answer if my reply answers your question.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

Great - thanks so much for the response, Joe.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

So basically, Square decides that business owners are not privileged enough to retroactively date things that get lost or neglected, but we can enter any arbitrary cash charge? 🤣

Only fraudulent reason to retroactively date a cash transaction is laundering, and I can do that easily by just entering arbitrary cash charges... ever seen Breaking Bad? It's my right to break the law if I so choose.

Seriously, I just need to go back a day or two and put certain values back in their place, geniuses. Tips, from someone who felt the need to do so a day later. Id simply like for the report tio be more accurate so I can track stats accurately by day

It's my business, I pay y'all for a service, now provide the service or I'll be glad to pay the extra .xxx percentage to a POS company that has this feature... like my bank.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

Hi @LUXtran - I do not foresee this feature coming to fruition within the Square ecosystem any time soon. Historically, we have determined that there is too much risk associated with being able to back-date transactions.

You should feel empowered to do what is best for your business - and we understand that you will. Thanks for your understanding.

Community Moderator, Square

Sign in and click Mark as Best Answer if my reply answers your question.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

Just for grins:

What risks? Cash transactions do not have any card information attached to them whatsoever. Not even customer names or any identifiable information unless manually entered. And do not say it creates a false document.

I will use a screenshot of your reply to clearly communicate my expectations to the next POS company.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

@LUXtran - we will refrain from jumping into hypotheticals here. If you are interested in more information, you can view other replies here on this thread.

Best of luck moving forward with your business.

Community Moderator, Square

Sign in and click Mark as Best Answer if my reply answers your question.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

I teach private lessons. Yesterday, I sent out invoices. This morning, a student's mother contacted me to tell me that - after she had already paid the invoice - she noticed that I had entered the wrong student's name, and asked me to please change it. I tried to edit the original invoice, but the system won't let me, since it has already been paid. I tried to make a new invoice, but I can't figure out how to mark it "paid". What should I do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

Hi @musicmasters-

Welcome to the Seller Community!

Because a paid invoice is considered a paid/completed transaction, you wouldn't be able to go back and change/edit the customer, amount, date, or payment method on the invoice.

We usually suggest refunding the original payment, creating a new invoice, and processing the payment with the correct customer profile. Really sorry about the frustration this has caused. I went ahead and moved your post over to this thread where other sellers have expressed a similar experience. Let me know if you have any questions about this.

Seller Community & Super Seller Program Manager | Square, Inc.

Learn about the Super Seller program!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

Thank you so much, Isabelle. I already sent her a new invoice, but I didn't know what to do with the incorrect one. I'll issue the "refund" now. Thanks again!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

This reply was created from merging an existing thread: I added payment to the wrong invoice

I recorded payment to a current invoice rather than the one that was due.. how can I fix it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

Hi there @hotbers - and welcome to the Community 👋

I've moved your post to this thread where a few other sellers have posted similar questions. I would recommend following the advice that @isabelle provided in her post here - definitely let us know if you have questions about this!

Community Moderator, Square

Sign in and click Mark as Best Answer if my reply answers your question.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

This isn't so much a question, as adding yet another voice to the request for a much needed feature that square is lacking. The ability to edit a past sale information. My situation is unique, but I don't think the need is. In my situation, I own a flea market where I have vendors that rent space in my building and I process their sales. (Its not the kind where each vendor runs their own booth) So in order to keep track in the system, I assing each vendor an ID, and have that listed as "Items" in my POS, so I can hit their ID, put in the price, and go. Now, in my situation, this becomes an issue if, #1, myself or one of my helpers rings a sale under the wrong ID/Item tag and doesn't catch it. I could refund of course and reRing it, but the report will still show a sale for that vendor, when it was not. #2, an issue that has happened is when refunds are involved. One time I had to ring up a customer who used two forms of payment, and I messed up because I didn't know how to do it at first as this was the first time. And I ended up ringing the whole thing as cash. So I had to refund it, and do it all over. It was a $75 item. So the report shows 2 items sold for this vendor, for $150. But does not record the refund of that ITEM, just a $75 refund in my total sales. Now, as I said, my situation is unique and very few would run their system this way. However, let my make this applicable for the most common type of buisness. Lets say it was a DVD, your item section will show that you sold 2 DVDs, when you only sold one, and this can mess up your inventory. If you sold a DVD, but say you messed up and hit Dishware, now your system will show you sold dishes instead of a DVD. There needs to be a way to correct these types of errors. A way to relable a sale to the correct item AND category. Being able to recategorize past sales will save me from having "Uncategorized" items in my sales report if I have to ring something new. Also, when an item is refunded, it should either be taken away from the item sales count, or moved to a new section of the report showing refunded items only, also removing it from the main sales count of items. This seems to me like a common sense feature that should have been worked into the system from the begining, but I am urging the developers to consider this and impliment these changes as soon as possible to make the square the best it can be.

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

Thanks for sharing @LHTFleaMarket! I added your post to this thread in order to keep the Community organized, and so we can keep better track of these requests.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

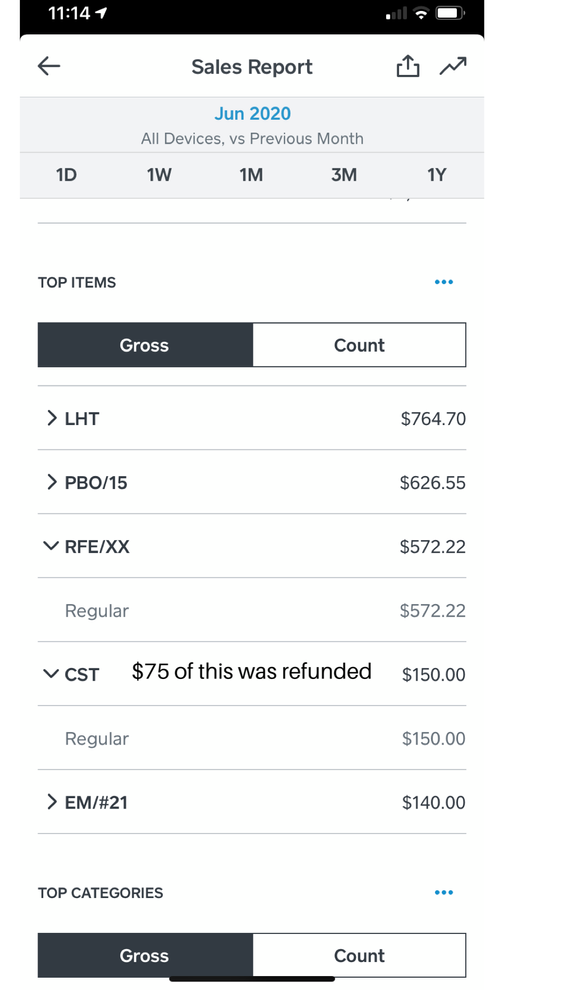

I want to provide this image as an example of why this needs to be addressed asap in the square POS. You see in my monthly sales report for June, the item labeled as CST, is showing I sold $150 worth. However, $75 of this was refunded, so I only have $75 actual dollars from this item. If this was a type of merchandise, this causes an error in counting what was sold vs in stock because the system says I sold 2, but in fact only 1 sold, due to an error in the transaction on my part that charged it twice but was refunded. However, in my situation since I operate similar to a consignment shop, this is actually a vendor ID, so now the system would show I owe this person more than I actually do. There is no reason that a refunded transaction should still show as a sale. It should be removed from this report, and have its own section of refunded sales. Please pass this request along to the developers because this should be put in place asap!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

I accidentally charged the school district taxes, however they didn't pay the taxes, which they should not have. I entered the invoice paid with the tax included, I don't know how to edit the amount they actually paid vs the amount I entered with taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

Hey @ajock!

Thanks for posting in the Seller Community.

Has the transaction already been processed? If so, you wouldn't be able to edit the amount paid or the transaction details. Take a look at the best answer in this thread for some insight into why.

You could charge them the tax amount in a separate transaction as a work around, but the two transactions wouldn't be associated. Or, you could refund the transaction, and then run it again with the right amount.

Seller Community & Super Seller Program Manager | Square, Inc.

Learn about the Super Seller program!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

Today someone completed a Square transaction with the iOS app that had a few items on it, and the customer paid by Visa. Later we found out that the sales person had selected the wrong product. Both the wrong and the right product cost $5, so there is no price difference, and taxes aren't involved.

Is there a way to edit the transaction to substitute the correct product?

From what I've found with searches here and in Google, is no, we can't edit the transaction. That right? Which kind of makes sense, I guess.

So how can I recover from this? We sell things on consignment, so my inventory and sales reports have to be spot on. (We're a small store that's part of a community school.)

Is my only option to keep an anomaly list and adjust reports at the end of the month or quarter? I'm hoping there's a better way built into Square. How do people deal with this sort of thing?

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

Hey @donkiely!

Thanks for posting in the Seller Community.

Unfortunately, you are correct. There isn't a way to edit or adjust the items within a completed transaction. You'd have to refund the transaction, and run it again with the correct items. So sorry about this!

I went ahead and merged your post with this thread. Please let me know if you have any additional questions.

Seller Community & Super Seller Program Manager | Square, Inc.

Learn about the Super Seller program!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

Thanks, Isabelle! I had seen that thread, so had little hope.

But my other question? I can't believe that this sort of thing doesn't happen often, we humans being as we are. So if I need out inventory and sales reports to be accurate, is there a best practice in Square how to handle it?

In this case, the customer is long gone, so there's no way to redo the transaction.

Please tell me I don't need to maintain an anomaly report and remember to adjust how we pay our partners!

Cheers,

Don

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

@donkiely This kind of thing happens a lot actually. I run a flea market where I have vendors but I process all of their sales. I have been begging Square to put in place a system that would allow us to change the item sold. The only way I've been able to keep track of each vendor sales is to put each one into my POS as an "Item". And sometimes a sale gets put under a wrong Item/vendor ID, so it messes up my reporting in square. Even just yesterday, I had 2 transactions that got rang up under the wrong item tag. And they where debit card transactions so the laughable "Refund" workaround is not an option. As the business owner, I should be able to go in and fix things like this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report